By now, you may be familiar with how Verdant’s energy management system can reduce electricity costs at a hotel property by up to 20%, improving the bottom line for franchisees and large Real-Estate Investment Trusts (REIT).

This post will take a deeper dive into how Verdant’s energy management system can increase the overall valuation of a hotel property for the purpose of resale. Admittedly, this may not be of importance to owners who plan to hold their investment(s) long-term, but it is highly relevant to large ownership groups who buy and sell hotels frequently.

Understanding Hotel Valuations

Historically, hotels have been valued based according to the “EV-to-EBITDA multiple” which is calculated by dividing Hotel Industry EV (Enterprise Value) by EBITDA. In the simplest terms, the EV-to-EBITDA multiple is a way for investors to compare the ROI of various businesses within the same industry despite differences in accounting practices.

Currently, the aggregated EV-to-EBITDA multiple for the hotel industry stands at 13.37 which means that the average hotel owner could expect to earn approximately 13x his annual EBITDA as final sale price of the hotel. You may be wondering what variables affect the EV-to EBITDA multiplier the most. Unsurprisingly, they are the same two variables that most greatly affect the typical hotel’s bottom line in any given year,

- ADR (average-daily rate)

- Occupancy rates

How Verdant’s Energy Management System Creates Value

So how does an energy management thermostat like Verdant’s create value beyond the tangible energy savings?

Let’s consider the example of a REIT that installs Verdant’s energy management thermostats in one of their typical limited-service hotels, with the intent of selling that property three years later.

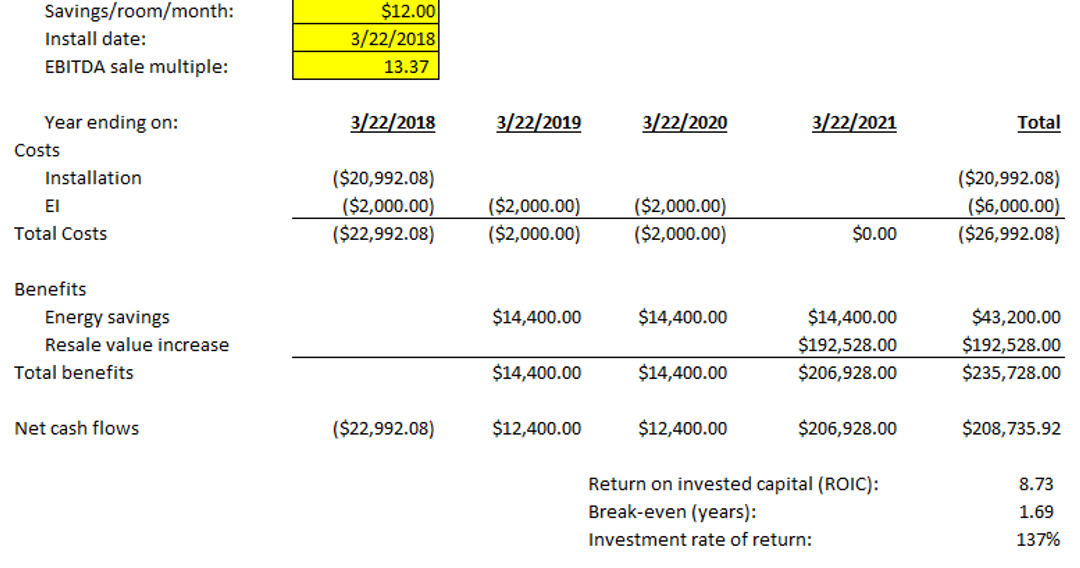

In year one, the purchase of Verdant’s system will cost the ownership group approximately $22,000. This includes a cash rebate of approximately $50 per room from the hotel’s utility company. The savings after year one are about 20% of the overall electric bill, which translates to $14,400 annually.

In years two and three, the system continues to save energy at the same pace, creating additional savings of $14,400 per year. By the end of year 3, the system has saved ownership $43,200 in operating expenses, at a cost of $27,000 in capital expenditure (including 3 years of Verdant EI™) – for a simple payback of 1.7 years. Normally our analysis would end here, but recall that in our example, the REIT is determined to sell this property after 3 years.

Since the $14,400 in annualized savings is a direct increase in annual EBITDA financial statements, we simply multiply $14,400 by the EV-to-EBITDA multiplier (13.37 as of today). The resulting calculation shows that Verdant’s energy management system has created over $192,000 in additional property resale value. Add in the 3 years’ worth of actual electricity cost reductions, and Verdant’s energy management system generated over $235,000 in additional value for this hotel in just 3 years while requiring a total investment of only $27,000.

The Bottom Line

This translates into a Return on Invested Capital (ROIC) of 8.7 times, and an Internal Rate of Return (IRR) of 137%. Very few investment opportunities available to hotel property owners will offer so much upside.